European equities: Strong equity outflows

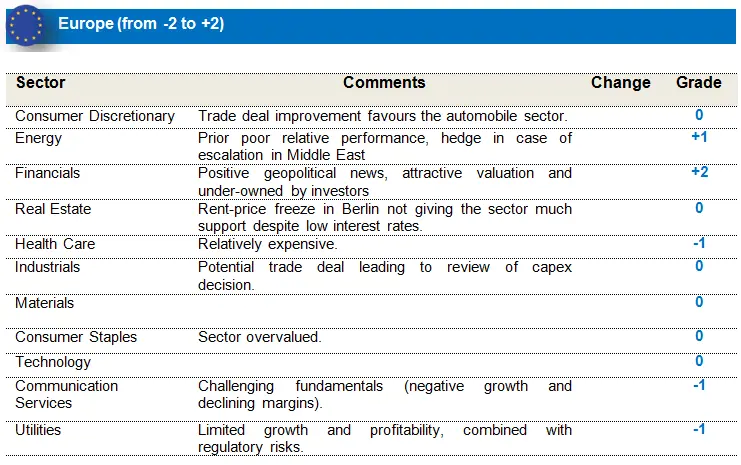

European equities sold off over January following fears around the coronavirus, despite positive economic data and positive news regarding Brexit and the trade war.

European equities sold off over January following fears around the coronavirus, despite positive economic data and positive news regarding Brexit and the trade war.

We saw strong equity outflows in Europe throughout the month, alongside a relatively attractive valuation compared to the US.

Utilities and Healthcare were the month’s best performers. The coronavirus caused a flight to safety in favour of the healthcare and utilities sectors. Moreover, as the virus spread, bonds rallied over fears of a slowdown in China affecting the world’s economy. Mechanically, Consumer Discretionary underperformed the market while the worst performer was the energy sector, due to the contracting oil price.

We are keeping our strong overweight exposure to retail banks based on recent strong figures and very attractive valuations. We are also keeping our long call on automobile while being short on luxury goods due to extreme valuations.

We are closely monitoring energy prices and, more specifically, OPEC/Iran/Russia’s decision to support (or not) the market by reducing their quota. Consumer Staples, HPC and Food & Beverages – while rather attractive – are under-owned. As a result, we are closely monitoring the case for a potential entry level.

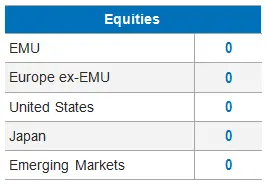

US equities: Resilient despite some selling-off

Global markets gave back some of last year’s strong gains while bond yields – dragged down mainly by global geopolitical tensions and the coronavirus news – collapsed, raising threats to the global economy.

US equity markets, which sold off slightly over January, appeared relatively resilient, given the fears around the coronavirus. This resilient situation can be explained by the strong earnings from the FANG names, strong economic data and positive news regarding phase one of the trade deal between the US and China.

Over the month, the Markit PMI showed mixed changes, while the Manufacturing PMI declined in the flash January report (disappointing expectations) and the headline activity index for the services PMI rose (beating expectations). The Philly Fed Manufacturing Survey improved more than expected, with solid details, as new orders, shipments and employment all moved higher.

We continue to see a strong relative performance in Information Technology, with solid positive earnings revisions and positive sales surprises. The utilities sector was the best performer in January, despite negative earnings revisions. Energy continue to underperform, due mainly to the current oil price.

We can expect a poor Q1 earnings season, as companies' margins will certainly suffer from the coronavirus. We are keeping our overweight position in IT as we are rather optimistic on the coronavirus, which might be resolved in the next few months. We are closely monitoring the situation to be able to reinvest our cash in strong quality companies at a good entry level.

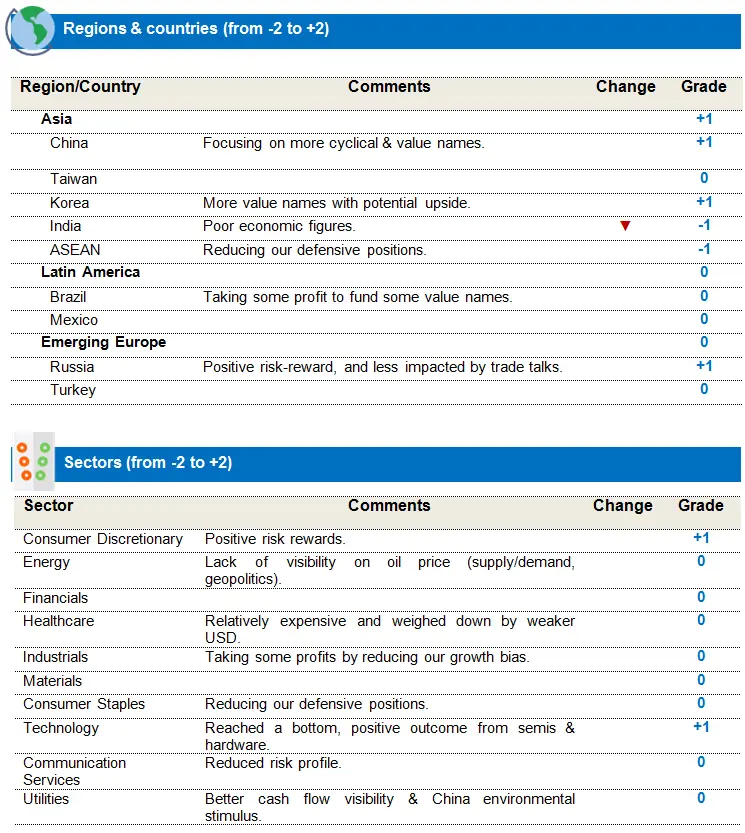

Emerging equities: coronavirus has contaminated Emerging Market returns.

Despite an initial positive market reaction to the signature of Phase I of the trade deal between the US and China, sudden tensions between the former and Iran following the killing of General Soleimani and, later, concerns over the impact of the coronavirus on global growth, weighed on the emerging markets, resulting in a 4.7% loss in January.

Commodities, too, lost, because of concerns over the potential return of the global growth slowdown, with the oil price down 15%. In Asia, even with several North Asian markets closed for the Chinese New Year, not only China, but all Asian markets suffered because of growing concerns over the coronavirus.

Even India, despite being more immune to the sell-off, was down. LatAm, too, fell in January, with all markets except Mexico correcting strongly on weak commodity prices and currencies. EMEA also lost, with South Africa reflecting the losses on the Rand, and Russia being impacted by the weaker oil price.

Precious metals were among the few asset classes to rally, as investors flew to safe havens amidst increasing market uncertainty. The dollar gained in January, with LatAm and Eastern European currencies the biggest losers.

With the exception of healthcare, all sectors ended the month of January in the red, with defensive sectors losing less than the more cyclical sectors.

We decided to reduce our Indian exposure to be “underweight”, as we have a slightly negative view on the region, based on poor economic figures. Non-Performing Loans (NPL) increased while economic reforms are not being carried out.

Despite the rising uncertainty, we continue to think that the stars are aligning for a better year for EMs. The timing of a slowdown in the virus outbreak and the Chinese reaction (as well as policy response) will be key to the pace of economic recovery and market sentiment.

Hence, while many risks remain on the radar, we remain vigilant in order to achieve positive (relative) performance in 2020. We are therefore maintaining a balanced portfolio, looking for "pockets-of-growth" with a thematic angle and quality companies.