In less than a month, Germany will vote to elect the new Bundestag, the German Parliament, which will eventually produce the first post-Merkel government in 16 years. Current polls suggest that elections will be followed by coalition negotiations, most likely between three parties. When concluded, a new Chancellor will succeed Angela Merkel.

In the meantime, Germany is facing numerous domestic and external challenges – an aging population, technological change and digitalisation, climate emergency, the growing role of China, public spending and risk sharing in the euro area, to name a few. While some of them have been exacerbated by the coronavirus crisis, the election campaign seem to lacks any sense of urgency to tackle these important issues.

What about the polls?

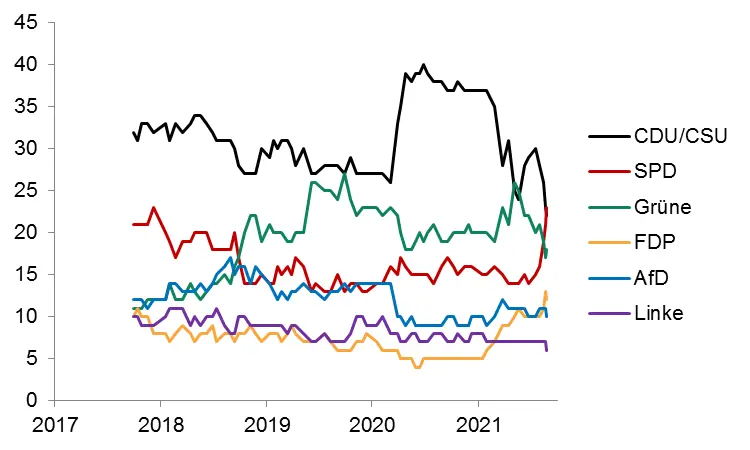

The centre-right conservative Union party block of CDU and CSU is no longer the likely winner as it has been losing momentum during the Summer. Similarly, the Green Party has been losing ground all along the campaign. The party gaining ground has been the centre-left SPD, which surged ahead of the Greens and is closing the gap with the conservative parties. It is expected that, due to the COVID-19 pandemic, there will be a sharp increase in the use of mail ballots, reaching the level of about 40% to 50%, compared to 28.6% at the previous general election of 2017, and 24.3% in 2013. This matters because voting by mail already opened across Germany on 16 August.

Volatile election poll indicators: German voters have been changing their minds

Sources: Forschungsgruppe Wahlen: Politbarometer, infratest-dimap, Forsa

Several coalition scenarios are likely on election night

The party winning the election in Germany also needs a majority in Bundestag, so it typically seeks to form a coalition in Parliament with another party. In our view, a clear outcome is not the most likely scenario on election night. This means that the winning party will need to form a coalition with not one but perhaps two parties, which will make coalition talks particularly painful.

Several coalition scenarios are possible after the general election, ranging from either a conservative-led or SPD-led government, with the Greens and the free-market FDP to a SPD-led government with the Greens and Die Linke, the democratic socialist party. The latter coalition would represent the most radical change to the status quo but is not the most likely scenario as current financial minister and SPD candidate for chancellorship Olaf Scholz is not a “left winger”.

In spite of an underwhelming campaign, the participation of the Green Party in government for the first time since October 2005 remains a distinct possibility. Among the political considerations, one has to take into account that the Green Party is likely to prefer being junior partner in a SPD-led government than in a CDU/CSU-led government, while the FDP would rather prefer the opposite.

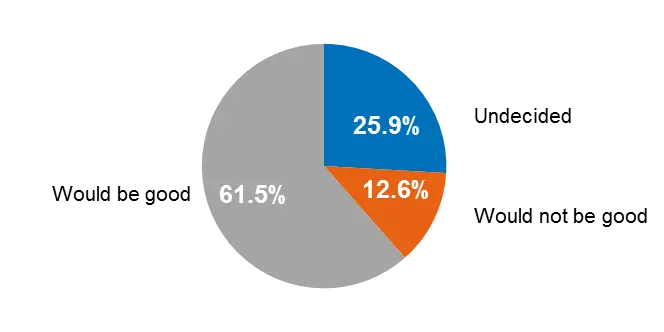

A wind of change for Germany

In a recent survey of the Bertelsmann Foundation, a large majority (61.5%) of those questioned wanted a change of Federal government. This view was expressed by all except CDU/CSU – affiliated voters. Among the Top Five areas in which a significant policy change or a new start is expected from voters, environment and climate change mitigation figure prominently, followed by Immigration, retirement, education. In the fifth place came the need for policy change in the fight against COVID-19, clearly not the main priority in Germany. We note that the German media has barely focused on these issues; instead, they preferred discussing pre-election political posturing by various party candidates.

Survey: Would it be good if the federal government changed at the general election on 26 September?

Source: Bertelsmann Stiftung “Wer schafft’s ins Kanzleramt?”

Broader implications

By definition, the first federal election without the incumbent will bring a leadership change to Germany. However, as a qualified majority of two thirds is needed to remove the “debt brake” or to make the EU recovery fund permanent and no government coalition is likely to yield as many votes, we should not expect any revolutionary shifts in policy. We think that the German answers to the most pressing questions will actually be positive for markets, as they are likely to result in more infrastructure spending and fostering domestic demand in other areas. Easier fiscal policy, a greater support for a banking union and more leeway in the upcoming discussion on euro area fiscal rules could also ultimately lead to a lower European breakup risk premium.