As we write, equity markets and liquid credit are rebounding aggressively, erasing a substantial part of the year’s losses. YTD, the Nasdaq and the S&P 500 are even positive. After the economic shock we are undergoing, this may seem, by many standards, utterly insane. Animal spirits are regaining vigour after encouraging signs of the virus spread being under control in Asia and Europe. However, let’s not forget that investors are sailing on sight. The economic impact of the virus will be massive and information available to assess it is still very limited.

As we write, equity markets and liquid credit are rebounding aggressively, erasing a substantial part of the year’s losses. YTD, the Nasdaq and the S&P 500 are even positive. After the economic shock we are undergoing, this may seem, by many standards, utterly insane. Animal spirits are regaining vigour after encouraging signs of the virus spread being under control in Asia and Europe. However, let’s not forget that investors are sailing on sight. The economic impact of the virus will be massive and information available to assess it is still very limited.

Argentinian and Brazilian equity indices were among the best-performing indices during May, returning around +15% and +9%. This relates more to a reversal of an oversold position. Argentina is still in talks with its creditors about debt restructuring and Brazil is one of the current pandemic epicentres. Healthcare and technology, flagged as the clear winners of this crisis, continued to perform well. Nasdaq Biotech returned close to +9% during the month, taking its YTD performance to the low double digits. European equity indices lagged US equities, returning low single digits during the month. While COVID restrictions seem to be coming progressively to an end, the widely needed relief funds offer proposed by the European Commission is not yet a done deal, due to challenges by the German constitutional court and the difficulties in obtaining unanimous approval by EU country members.

Most Developed Market short- and medium-term rates are now yielding nothing, or negative returns, leaving Emerging Markets as the only region where investors can find some yield. Most of the action is taking place in the credit space, with Investment Grade, Fallen Angels and selective High Yield issues having significant inflows leading to narrower spreads.

Although the WTI jumped +85% during the month, the spot price is still trading at $35.57, close to the historic lows of the last 20 years.

The HFRX Global Hedge Fund EUR gained +1.19% over the month.

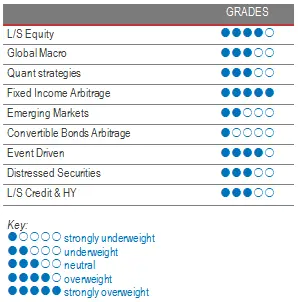

Long short equity

It was a good month for Long Short Equity strategies, with funds averaging positive returns between +1% and +3%. Overall, Long Short Equity strategies come across as a winning range of strategies and one of the best performers since the beginning of the COVID crisis. The liquidity of the underlying asset and the modularity of their net exposure allowed them to decrease risk at the beginning of the pandemic and progressively shift capital to businesses and thematics that would benefit from the crisis. During the month of May, LS Equity funds’ performance was hurt by factor rotations in the second part of the month and by shorts outperforming long positions. As the equity rally extended into May, investors started rotating from crowded quality and growth stocks into oversold sectors and styles like cyclicals and value. The negative alpha generated by the short book partially mitigated the very strong alpha generation from long investments. From a regional perspective, American-focused LS funds have outperformed, in absolute terms, European-focused LS funds, returning respectively, and year-to-date as per the end of May, -2.9% and -4.7%. However, on a relative basis, European LS funds outperformed, capturing 30% of the market downside versus 60% downside capture for American funds. According to brokers, the current equity market rally may have legs to continue, considering the level of participation by institutional investors has been relatively limited. However, taking the example of the S&P 500, in the current economic context, where much of the damage has yet to be discovered, the P/E NTM index stands at 21.46 and the Shiler CAPE normalized earnings ratio is over 30X. Taking history as our guide, at these valuation levels, forward 10-year equity returns will average a negative annualized return of -8%. Long Short Equity strategies are, therefore, in our opinion, an interesting strategy to consider for navigating the current market environment, since they can modulate their risk appetite and generate returns from their long and short positions across a very wide range of investment themes. Good stock-pickers will be able to select winners and losers.

Global Macro

Performances were relatively dispersed but, overall, rather flattish for Global Macro strategy indices. Discretionary strategies generally outperformed systematic investment programmes. Discretionary managers, able to benefit from selective directional trades, made money mainly from rates and long equity index positions. Systematic strategies, which tend to be more diversified by nature and rely on observable data, are having more difficulties dealing with market noise. Considering the high volatility levels and future uncertainty, fund managers are constantly reassessing current positions. The massive stimulus programmes announced by central banks and governments all around the world should help stabilize the market. However, until the current health crisis has been contained and we learn to live with it, the outlook will be foggier. In this environment, we tend to favour discretionary opportunistic fund managers who can draw on their analytical skills and experience to generate profits from a few strong opportunities worldwide. The stabilisation of the market and increased visibility in macro-economic data should lead to better performances from systematic strategies, with expected lower realized volatility levels than the more concentrated discretionary managers.

Quant strategies

2020 has not been an easy environment for Quantitative Strategies. Models had difficulties dealing with the violent and rapid increase in market volatility and asset correlations between the end of February and April. The extreme and prolonged volatility levels reached during March led to a significant deleveraging of quantitative strategies, generating poor performance and leading to more deleveraging. The implementation of the stock-shorting ban on some European countries helped accentuate the deleveraging effect because managers were unable to implement or adjust the optimal portfolios of long and short securities as defined by their model. At the end of May, market participation by Quant funds was still limited due to relatively high volatility levels as per recent market averages. CTAs, one of the best-performing subset strategies for the year, delivered on average muted performances during the month of May, with long winning trades on fixed income and equities balanced by losing shorts on oil futures and US dollars. On the positive side, recently launched Statistical Arbitrage Long Short Credit Market Neutral funds printed impressive returns, pointing to a relatively uncrowded source of alpha generation.

Fixed Income Arbitrage

If Fixed Income Relative Value had one of its most spectacular months ever in March 2020, it has highlighted the need to be invested in managers with strong set-ups (secured-term repo lines with high-quality counterparts and longstanding relationships). At the end of March, our managers took advantage of the dislocation within the US basis to post historical positive returns from what has been a once-in-a-decade opportunity. As we come close to the June expiry, basis positions have been rolled down on the September expiry, which seems quite attractive, even though not as good as the opportunity set in March. Like other RV trades, spreads are wider than they were pre-crisis, and we reiterate our positive stance on the strategy.

Emerging markets

On average, May was very positive for Emerging Market strategies, where discretionary managers benefited from improving market risk sentiment to bank on selective trades. Fundamental managers stress that, in a zero-rate world, Emerging Markets is the only alternative to investing in yielding fixed income. However, considering the fragility of fundamentals, they usually adopt a very selective approach. Trades are mainly implemented by investments in fixed income, credit and currencies where fear-dominated risk-pricing is creating massive dislocations and opportunities by ignoring the fundamentals specific to each region. The market is cyclical and, as such, current massive dislocations are the seeds of future investment opportunities at more interesting entry points. Nonetheless, we remain cautious about the strategy, because, on top of fundamental considerations, EM assets might suffer from outflows of capital-chasing opportunities in DM High Yield, and from a lack of liquidity.

Risk arbitrage - Event-driven

May was positive for Event-Driven strategies but performances were mainly driven by more beta-sensitive Special Situation books, which outperformed Merger Arbitrage books. Special Situation strategies have been extremely active since late February, mainly through the active trading of credit issues. Hedge Funds were providing liquidity to the market, buying billions of dollars of Investment Grade and Fallen Angels issues at 20-point discounts. Turnaround was high and competition to get allocations was fierce as market participants leveraged down to meet collateral requirements. Within Merger Arbitrage, spreads continue to normalize, pricing on average a mid-single-digit gross spread (around +30% IRR) for an expected deal-completion probability of around 80%. Although deal activity has slowed on a Year-on-Year basis, new deals announced during the month of May might indicate a resumption of activity (e.g., Grubhub to be acquired by JustEat). It is important to remain selective in deal selection due to the increased risk of deal failure.

Distressed

Distressed opportunities have finally arrived but not in the way we were thinking of. Instead of reaching the end of the credit cycle progressively, the coma-induced world economy has made businesses crash against the wall at a high speed. The question is therefore not about whether there will be distressed opportunities, but about how many. We hope that the monetary and fiscal stimulus plans being put together will be effective and limit the damage to our economies. However, it is a fact that they will not be able to save every business in the world. From the discussions we held with experienced managers, we gathered that credit was being sold off with aggressive quotes not only for fundamental reasons but also due to a lack of liquidity. Distressed managers are not rushing to dive right in. Assets being sold require deep fundamental analysis to be bid at the right price. Most managers have segmented this market dynamic into 3 phases. They started by buying discounted Investment Grade securities, trading them dynamically and selling them relatively quickly, as widening liquidity spreads started to close. They then initiated a more selective phase of buying Fallen Angels and selective High Yield securities. The third and final phase is yet to begin. This is the moment when businesses start effectively to default, which is expected to increase more significantly during the 3rd and 4th quarters of 2020. Moody’s and S&P projected default rates are respectively 13.3% and 12.5%. During the last three recessions, irrespective of the duration and level of these, default rates always peaked at around 10%. This time, however, the size of the economic shock is much bigger than anything we have met before. It is therefore probable that many credit assets may still correct to adjust to the severity of the crisis.

Long short credit & High Yield

Credit spreads for Investment Grade and High Yield markets reached extreme levels unseen since the crisis of 2008. The market was also highly affected by the lack of liquidity, prompting the ECB and the Fed to step up their IG debt-purchasing programmes. The Fed also decided to include High Yield in its buying programmes to smooth the high amount of Investment Grade fallen angels downgraded to High Yield. Rating agencies forecasted that the amount of fallen-angel debt could reach $700 billion in the US, probably too big to be absorbed by the HY market smoothly. Investment Grade and short-term High Yield issue spreads reacted very quickly to liquidity injections, especially in the US. According to the managers we track, while this move in higher-quality issues was widely expected, there are still many opportunities in High Yield but also in the cross-asset relative value trades (long bond vs short equity) and intra-asset RV trades (long bonds and long protection) generated by the market dislocations. Contrary to 4Q 2018, opportunities offered in credit will take longer to be arbitraged, leaving time for investors to review their allocations.